Conversations

Alberta’s Carbon Levy: Taxing Matters - Understanding Alberta’s Carbon Levy

By Tracey L. Anderson

March, 2017

Carbon tax. In Alberta, these two words are likely to ignite a heated conversation. In fact, many people can’t even agree on what to call it. Officially, the price-on-carbon system that came into effect January 1, 2017, is called a carbon levy, but many refer to it as the carbon tax. That, however, is only the tip of the carbon debate. Staggering amounts of information from both sides of the debate compound the confusion. This primer on the levy can help you separate truth from rhetoric and decide, for yourself, whether or not the levy has merit.

Why Is Carbon a Big Deal?

Every living thing—plant or person—contains carbon (45% and 18%, respectively). This fact is significant because carbon combines easily with other elements to form new compounds. For example, one carbon atom combines with two oxygen atoms to form carbon dioxide (CO2). And therein lies the big deal.

Carbon dioxide is a greenhouse gas, which is a by-product of burning fossil fuels such as coal, oil and natural gas. In the atmosphere, CO2 traps heat close to Earth in the greenhouse effect. And although the greenhouse effect keeps the planet from freezing, too much CO2 makes the planet too warm and contributes to climate change. The negative effects of climate change include increasing temperatures, melting Arctic sea ice and rising water levels. One way to reduce the greenhouse effect is to reduce carbon emissions. That’s where the carbon levy concept comes in.

The Levy & Its Purpose

According to the Government of Alberta carbon-pricing website, “Alberta’s carbon levy provides a financial incentive for families, businesses and communities to lower their emissions.” The theory is that people and companies will try to lower or eliminate their fees by becoming more energy efficient and moving away from high-emission fuels. But how are those fees calculated and charged?

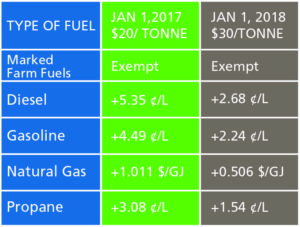

A levy is charged on all greenhouse-gas-emitting transportation and heating fuels such as diesel, gasoline, propane and natural gas. Farm fuels are exempt. The current levy rate is $20/tonne, which will rise to $30/tonne in 2018.

This Alberta Treasury Board and Finance table shows the levy for specific fuels.

The current levy isn’t the first carbon-pricing scheme in the province. According to Calgary Southeast MLA Rick Fraser, an Energy, Environment and Sustainable-Resource-Development Critic for the Progressive Conservative (PC) caucus, “Alberta has had a price on carbon since 2008, when the Progressive Conservative government of the day introduced a $15/tonne fee for heavy emitters, known as the Specified Gas Emitters Regulation [SGER]. At the time, we were the first jurisdiction in North America to put a price on carbon.”

The current carbon levy, however, doesn’t replace the SGER, which large industrial emitters are subject to until the end of 2017 when the Province will move to an output-based allocation (details are not yet set). Combined with those forthcoming industrial emitter regulations, the government’s full carbon-pricing model is expected to cover 70 percent to 90 percent of Alberta’s emissions as part of its broader Climate Leadership Plan.

The Climate Leadership Plan

In summer 2015, the Climate Change Advisory Panel was formed. The panel was chaired by Dr. Andrew Leach, an associate professor in the Alberta School of Business with a PhD in Economics and a Bachelor of Science in Environmental Sciences. The panel gathered opinions from the public, academia, industry and other stakeholders through public open houses, online surveys and written submissions. The panel’s fall 2015 report informed the Climate Leadership Plan, which passed into legislation in May 2016. The Plan aims to reduce carbon emissions, diversify the economy and create jobs. The carbon levy is one strategy in the Climate Leadership Plan; these are the other strategies:

• Ending pollution from coal-generated electricity by 2030

• Developing more renewable energy

• Capping annual oil-sands emissions at 100 megatonnes

• Reducing methane emissions by 45 percent by 2025

Many Albertans believe that when the federal government implements its carbon levy in 2018, they will pay both. This, however, is a misconception; the federal government announced that provinces must enact an emissions reduction plan or Ottawa will impose a federal carbon tax. Marie Renaud, Member of the Legislative Assembly (MLA) for St. Albert and a member of the NDP Government says, “Our Climate Leadership Plan ensures that Albertans are supporting a provincial levy that meets our province’s needs, instead of a one-size-fits-all program imposed by Ottawa.”

What’s In a Name?

To begin to understand how divided and/or confused Albertans are about this issue, look no further than what this price-on-carbon system is called: the government says it’s a levy. Others call it a tax. So which is it? And why does it matter?

MLA Renaud explains the Government’s position.

“The carbon levy differs from a tax in that it is usage-based. Unlike income tax, for example, in which everyone pays a certain amount based on their earnings, the carbon levy is solely based on how much someone spends on products subject to the levy. By reducing emissions, the amount someone pays is also reduced.”

Dr. Jennifer Winter, Assistant Professor and Scientific Director in the Energy and Environmental Policy Research Division of the University of Calgary’s School of Public Policy, thinks otherwise. She considers the levy a tax because, “it is a corrective price on goods and services levied by the government.” Dr. Winter has a PhD in Economics and specializes in energy and environmental policy.

MLA Rick Fraser says the name doesn’t matter:

“Whether it’s called a tax or a levy, it’s another expensive burden for Alberta families to handle during these troubling economic times.”

The Wildrose Party was contacted for this article but did not respond.

What Will Be Done with the Money?

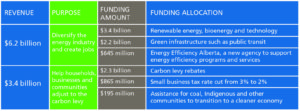

Over the next five years, the Government estimates that revenue from the Climate Leadership

Plan, including the carbon levy, will be $9.6 billion. The money will be reinvested in Alberta, allocated as follows.

The proposed allocation of funds is yet another point of contention. While the Government plans for the money to be reinvested in Alberta, the PC party believes that the levy should be revenue-neutral, where money collected would go back to Albertans through corporate and personal tax cuts or would pay down the provincial debt.

Will You See a Rebate?

Rebates for some Albertans are embedded in the carbon levy’s structure. As MLA Renaud explains, “Rebates are limited to lower- and middle-income earners because they will feel any added costs of the levy more acutely.”

About 60 percent of households get a full rebate: $200 for an adult, $100 for a spouse and $30 for each child under 18 (up to four). Single Albertans who earn up to $47,500 and couples, single parents and families who earn up to $95,000 receive full rebates. Other households may receive partial rebates. Amounts are calculated based on Family Adjusted Net Income from the previous year’s personal income tax returns. Depending on the total amount, eligible households receive up to four automatic rebate payments each benefit year, which runs from July to June. Busi nesses aren’t eligible for rebates, but the small-business corporate income tax was reduced from 3 percent to 2 percent.

To estimate your carbon levy costs and rebate, visit the online levy calculator. alberta.ca/calculate-carbon-levy-rebate-and-costs.aspx

Although rebates might seem like a good thing, not everyone agrees. MLA Fraser says, “We agree with insulating low-income Albertans from a tax that they simply cannot afford, but we do not agree with the NDP rebate structure. […] We can have effective policies to reduce carbon emissions without using it as an excuse for wholesale redistribution of wealth.”

Dr. Winter, however, says, that although the eligibility criteria are arbitrary, “given the policy goal of compensating lower-income Albertans, the structure and implementation is appropriate.”

The Environmental Debate

Environment and Climate Change Canada has adopted a concept called the Social Cost of Carbon (SCC), which is “a monetary measure of the global damage expected from climate change from the emissions of an additional tonne of carbon dioxide (CO2) in the atmosphere in a given year.” The concept is based on research by the United States Interagency Working Group on the Social Cost of Carbon in 2010.

Scientific data points to many kinds of global damages from increased carbon emissions. These damages are far ranging. The Intergovernmental Panel on Climate Change (IPCC) was established in 1988 by the United Nations Environment Programme (UNEP) and the World Meteorological Organization (WMO). Its mandate is to provide “a clear scientific view on the current state of knowledge in climate change and its potential environmental and socio-economic impacts.” In its Climate Change 2014 Synthesis Report Summary for Policymakers, the organization outlines those impacts in detail, including extreme weather events (droughts, floods and heat waves); melting snow and ice (which affects quantity and quality of water resources); changes in animal migration patterns; and changes in crop yields. According to the report, “Continued emission of greenhouse gases will cause further warming and long-lasting changes in all components of the climate system, increasing the likelihood of severe, pervasive and irreversible impacts for people and ecosystems.”

Environment and Climate Change Canada has estimated the SCC at $46/tonne. Dr. Winter believes Alberta’s levy rate of $20/tonne rising to $30/tonne is too low, suggesting it should be adjusted to match the SCC. However, she also says,

“It is economically costly for Alberta to price emissions when other provinces and countries are not doing so.”

For its part, the PC caucus believes that the government shouldn’t set any price. “The carbon price should be set by the market. There is no need for government to set an arbitrary price floor or ceiling, which stifles innovation and investments.”

The Economic Debate

The main complaint from levy opponents is that it increases prices for consumers—and not just at the gas pump. MLA Fraser says,

“While 4.49 cents per litre may not seem like much to the average Albertan, there are a wide range of businesses who rely on ground transportation to get their goods and services to and from market. This additional gasoline cost will quickly add up and result in those additional costs being passed down to consumers.”

Winter agrees that all prices will increase, but by how much depends on the energy and emissions intensity of each good or service.

The Government estimates indirect costs (for items not directly subject to the levy) at $50 to $70 in 2017 and $70 to $105 in 2018 for the average family. MLA Renaud notes, though, that energy-efficiency programs funded by the levy will reduce electricity bills, and “gas prices will continue to go up and down as they always do in Alberta, with or without a carbon levy.”

With the current challenging economic times in Alberta, levy opponents are concerned about the timing. MLA Fraser says, “Now is not the right time for an economy-wide carbon tax. We are still struggling with one of the worst economic crisis our province has seen in a generation…. The imposition of additional costs at a time when Albertans can least afford it only hurts Alberta families.”

Dr. Winter disagrees. She says, “We have estimates of the cost of climate change; not pricing carbon only increases the potential damages and future costs.” The Government stance is along similar lines. As MLA Renaud explains, “The reality is that the cost of doing nothing, both to our economy and the environment, will only increase the longer we put off taking action.”

Will It Even Work?

Perhaps the biggest question is “will the carbon levy reduce emissions?” It’s no surprise opponents believe it won’t. MLA Fraser says,

“By the Government’s own admission, 60 percent of Albertans will receive a full or partial rebate, insulating them from the financial impacts of the tax. If they feel no impact… what incentive is there to take steps to reduce carbon emissions?”

In contrast, Dr. Winter believes the levy will reduce carbon emissions because “making something more expensive means people and businesses change their behavior—this is a fundamental principle of economics.” She says evidence from BC and other jurisdictions suggests that carbon pricing leads to lower emissions, but “the magnitude of the change depends on the behavioural response, which is trickier to predict.” She also says, “Economists have evaluated the relative options available to reduce emissions—regulation versus pricing—and pricing is the least-cost way to reduce emissions.”

MLA Renaud explains that the effects on emissions won’t be immediate.

“Alberta has been moving in one direction for so long, and that won’t change overnight. To balance the growth of our economy with our need to be environmentally responsible, we are taking a gradual, reasonable approach.”

Common Ground

Climate change and carbon emissions are contentious issues. But what, if anything, do both sides agree on? MLA Fraser says that contrary to public perception of the party, “we know that human-caused climate change is real and an important issue that must be addressed. […] Albertans care about our environment and we want to protect it.”

The differences appear to be about how best to achieve that protection. Some feel the carbon levy policy is the wrong approach; others, including the Government, strongly believe we must act now to reduce carbon emissions. MLA Renaud says, “The costs of adapting and taking action today will result in the avoidance of damage and, therefore, the avoidance of future costs. […] Putting a quantifiable price tag on our emissions is a small but crucial first step to mitigating the effects of climate change on environment and economy.”

Dr. Winter goes further, adding, “The current [social] cost of emissions is higher than the current [levy] price, and so even if the revenues were thrown in the ocean, it would still be a worthwhile policy.”

Whether you like it, love it, hate it or ignore it, the carbon levy is here to stay—at least until the next election. Then you can have your say on its merits at the ballot box.

For more information about the carbon levy, visit alberta.ca/climate-carbon-pricing.aspx. t8n